- Shanghai Zhongshen International Trade Co., Ltd. - Two decades of trade agency expertise.

- Service Hotline: 139 1787 2118

solarphotovoltaicAs an important component of clean energy, it has received widespread attention and investment globally. Particularly in the US, a series of policies and regulations have been introduced, demonstrating its determination to strengthen the localization of photovoltaic industry production. Recent policy and regulatory changes have brought new challenges and opportunities to the photovoltaic industry. Below is an in-depth analysis of the background of US photovoltaic subsidy policies and the legal definition of domestic manufacturing.

I. Background of the US Photovoltaic Subsidy Policy

(I) Multidimensional Sino - US Photovoltaic Trade Barriers

1. Double Anti actions:Since 2011, the United States has carried out a series of anti - dumping and counter - vailing investigations on Chinese photovoltaic products, resulting in high punitive tax rates. The highest anti - dumping tax rate is238.95%, and the counter - vailing tax rate is15.24%.

2. Section 201 tariffs:In January 2018, the United States imposed a tariff starting from30%on solar cells imported from China, which decreased year by year thereafter.

3. Section 301 tariffs:In September of the same year, a tariff starting from10%and subsequently increased to25%was imposed on photovoltaic products imported from China.

4. Withhold Release Orders and the Uyghur Forced Labor Prevention Act:The United States has implemented a series of import restrictions and seizures on photovoltaic products from Xinjiang, China.

(II) US Domestic Photovoltaic Support Policies

(1) Investment Tax Credit (ITC)

ITC is an important tax incentive policy launched by the United States, aiming to encourage individuals and enterprises to invest in photovoltaics. Through this policy, investors can offset income tax according to a certain proportion of their total investment, thereby reducing the initial investment cost and promoting more capital to flow into the photovoltaic industry.

Details of the Credit

(a) Basic Credit:For projects larger than 1MW, the basic investment credit rate is 6%. If the project starts construction within the specified time limit or meets specific requirements, a 30% tax rate credit can be enjoyed. For projects smaller than 1MW, a 30% tax rate credit is directly available.

(b) Additional Credit:Projects that meet the domestic manufacturing standards can obtain an additional 2% or 10% credit on the basis of the basic credit rate. At the same time, projects located in specific energy communities or low - income communities can also enjoy an additional 10% or 20% tax rate credit.

(2) Production Tax Credit (PTC)

PTC is a tax credit policy for energy producers. It focuses on the power output of the project and provides a tax credit according to the power generation per kilowatt - hour (kWh), providing continuous financial support for the continuous operation of the project.

Details of the Credit

(a) Basic Credit:The basic credit of PTC is divided into two situations. For projects larger than 1MW, the basic credit unit price is 0.3 cents/kWh. If the project starts construction within the specified time limit or meets other requirements, a credit unit price of 1.5 cents/kWh can be enjoyed. For projects smaller than 1MW, a credit unit price of 1.5 cents/kWh is directly available.

(b) Additional Credit:Projects that meet the domestic manufacturing standards can obtain an additional 10% credit on the basis of the basic credit unit price. Projects located in specific energy communities can enjoy an additional 10% tax rate credit.

In addition to the above - mentioned ITC and PTC, the US government has also introduced various other forms of policies to support the domestic photovoltaic industry.

For example:

Direct Subsidies and Loan Guarantees:Provide direct financial subsidies and loan guarantees for the initial construction and operation of photovoltaic projects.

R & D Support:Provide R & D funds to promote the further innovation and development of photovoltaic technology.

Market Promotion:Implement a series of market promotion activities to increase the popularity and application of photovoltaic technology among the public and enterprises.

II. Definition and Implementation of Domestic Manufacturing

According to guidance issued by the US Internal Revenue Service (IRS) on May 12, 2023, the specific definition of domestic manufacturing in the photovoltaic industry was clarified.

Core requirements include:

Steel manufacturing:The steel used in the project must be 100% made in the United States, especially those used as structural building materials.

Proportion of manufactured goods:For manufactured goods, the proportion of components made in the United States must meet certain standards. Since 2023, the proportion of domestic manufacturing in the United States needs to exceed 40%, and gradually increase in the following years, reaching 55% by 2025. For offshore wind projects, the initial requirement for the proportion of domestic manufacturing is 20%, and it will be increased to 55% in 2027.

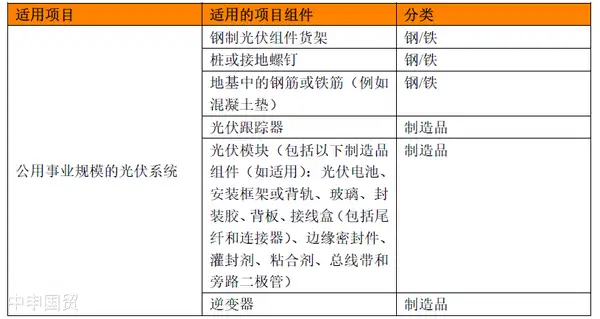

In the guidance, the IRS classified the project components involved in the photovoltaic system into steel and manufactured goods categories:

The guidance also explained the calculation method of the proportion of manufactured goods:

If all manufacturing processes and components of a manufactured good are from the United States, then the manufactured good is a U.S.-made product.

If some components of a manufactured good are from overseas, even if the manufactured good is produced in the United States, it is not a U.S.-made product.

3. However, as long as all manufactured components in the final project account for more than 40% of the cost being domestically manufactured in the US, the project qualifies for additional domestic manufacturing tax credits. Projects meeting the domestic manufacturing definition receive additional tax credits on top of the base credit, such as an extra 2% or 10% tax credit.

III. Flexible Implementation of US Domestic Manufacturing Policy

The US has shown significant flexibility in the design of its domestic manufacturing policy for the photovoltaic industry.

Generally speaking, photovoltaic cells account for about 30% of the product cost of solar facilities. But in the global photovoltaic industry chain, China has become the main producer of silicon wafers, cells and photovoltaic modules. Data from the International Energy Agency reveals that China has the vast majority of silicon wafer production capacity, as well as 85% of cell production capacity and three - quarters of photovoltaic module production capacity. Polycrystalline silicon cells, as the dominant technology in the market, also have their production chains mainly in China. While the United States is relatively weak in the supply chain of polycrystalline silicon cells.

(1) No clear restriction on the origin proportion of cells

Although the US has set clear requirements for the domestic proportion of steel and manufactured goods in its domestic manufacturing policy, there are no explicit restrictions on the origin ratio of solar cells. According to proposals by the Solar Energy Industries Association (SEIA), as long as the panels are assembled in the US, regardless of where the cells are produced, they should qualify for tax credits.

(2) Real - world background and policy design

Given that the United States itself is not a major producer of polycrystalline silicon cells, if forced to require domestic production of solar cells, it will hinder the development of the U.S. solar energy industry and the deployment of technology. Therefore, in policy design, the United States has chosen a compromise strategy, allowing the import of solar cells and trying to meet the requirements of domestic manufacturing in other parts as much as possible.

Reference materials: IRS guidance Domestic Content Bonus Credit Guidance under Sections 45, 45Y, 48, and 48E

Related Recommendations

? 2025. All Rights Reserved. Shanghai ICP No. 2023007705-2  PSB Record: Shanghai No.31011502009912

PSB Record: Shanghai No.31011502009912